CW47: Bitcoin’s Big Move: Corporates, ETFs, and Soaring Stock Volumes

How Capital Markets Are Finally Doubling Down on Bitcoin

Good Monday Morning, and welcome to the first Berglinde Briefing!

We’re kicking off the week (and our newsletter) with sharp Bitcoin insights tailored for financial professionals like you. Grab your coffee, settle in, and let’s dive into the latest trends driving Bitcoin’s growing presence in capital markets.

What we are talking about today

News Flash: Bitcoin ETF break all records & MicroStrategy one of the most traded stock and its playbook is copied worldwide

Institutional Flows: A Look at Investment Inflows and Outflows

Graph Of The Week: Feeling the Pinch: Why Inflation Stats Don’t Match Everyday Experience

Selected Jobs In the Industry

Meme Of The Week: Christine Lagarde practices her new signature

Flash 1: Bitcoin ETF break all records

Bitcoin has now eclipsed Saudi Aramco to claim the title of the seventh-largest asset globally by market capitalization. U.S. Bitcoin ETFs have seen a substantial influx of $4.7 billion in the past six days, reflecting a significant investor interest. BlackRock's IBIT 0.00%↑ has set trading volume records, indicating robust market engagement. There's also emerging interest in Bitcoin ETF options, suggesting a deepening of market instruments. This development underscores Bitcoin's transition from a niche digital currency to a mainstream investment vehicle.

Those numbers make it the by far fastest growing ETF launch of all time:

So obviously lots of people say that it’s overheated. In reality though it’s still only half the size of NVIDIA, the currently most valuable company.

Flash 2: MicroStrategy goes on another buying spree

Michael Saylor has done it again: MicroStrategy just announced another colossal Bitcoin purchase—27,200 BTC for roughly $2.03 billion. This acquisition brings their total stash to an eye-popping 279,420 Bitcoin, solidifying their reputation as the ultimate corporate hodler. What’s more, they’re doubling down on their Bitcoin bet with a bold financing plan to raise $42 billion, split evenly between equity and debt, for—you guessed it—more Bitcoin.

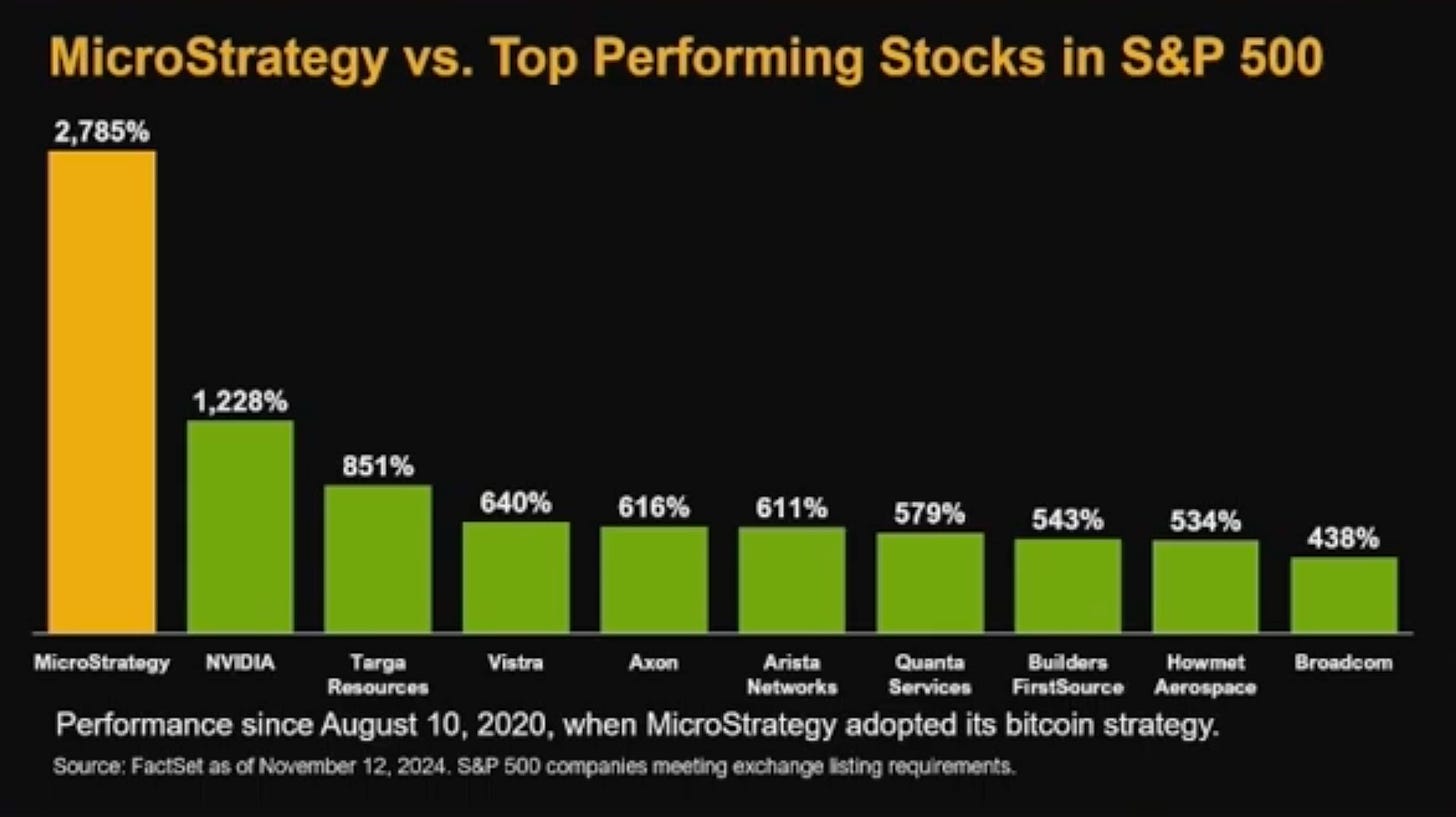

Critics may scoff at Saylor’s audacious strategy, but the results speak for themselves. MicroStrategy's stock (MSTR) has not only outperformed over the past four years but has also been one of the most actively traded. Add to that an impressive Bitcoin yield—26.4% year-to-date for what essentially means increase in Bitcoin-per-share—far outpacing competitors like BlackRock’s ETFs, which are in the red at -0.25% due to fees. Love him or loathe him, Saylor’s Bitcoin playbook continues to make waves in the financial world.

MicroStrategy hasn’t just outperformed every other stock by a wide margin; its strategy is refreshingly straightforward compared to the monumental task of building another Nvidia.

It’s no surprise that many companies are exploring this opportunity right now.

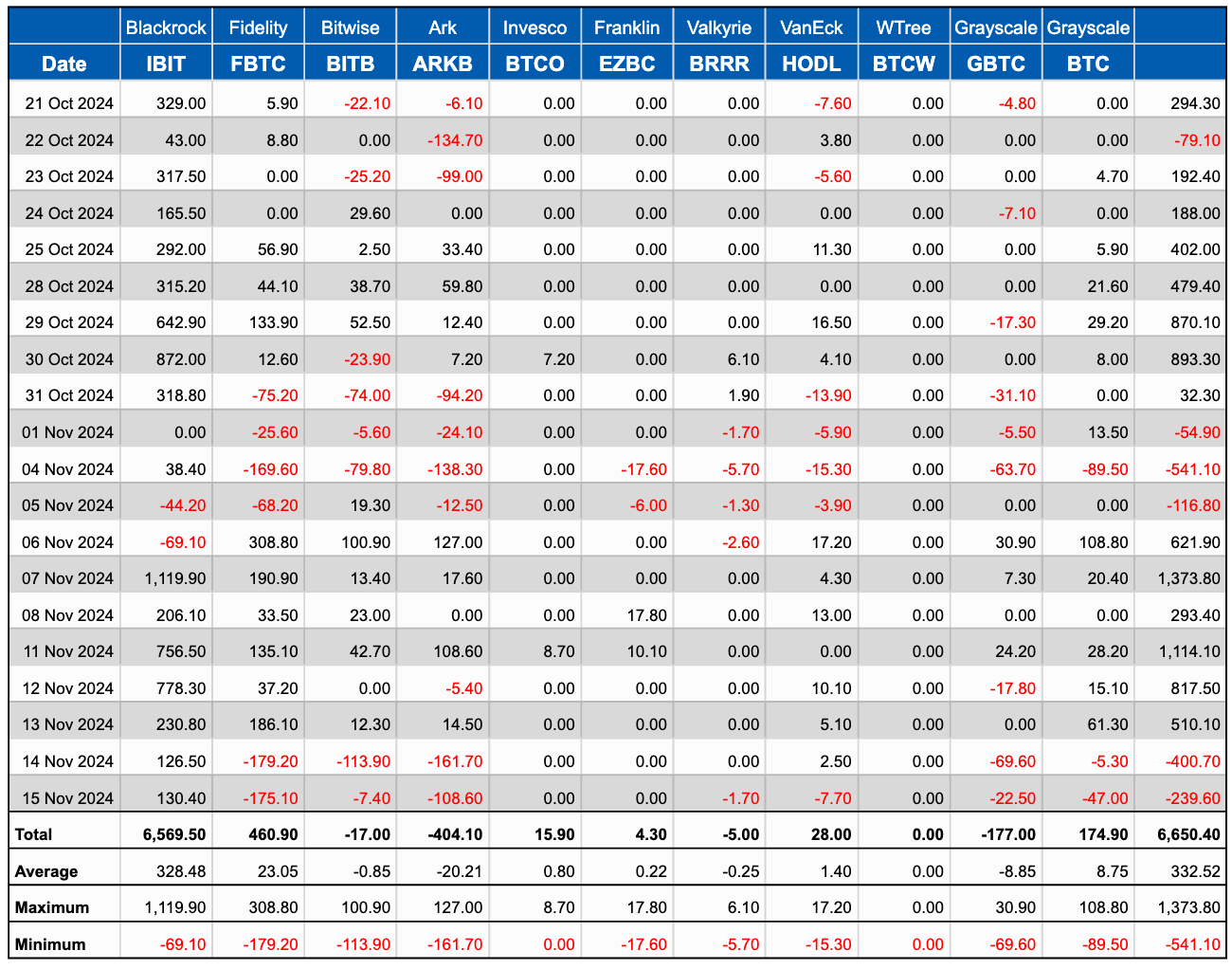

After an unprecedented surge in inflows into Bitcoin ETFs, some profit-taking emerged towards the end of last week. Leading the pack, BlackRock’s ETF saw a jaw-dropping average inflow of USD 328 million per day over the past four weeks—a pace unmatched by any other issuer.

For perspective, around 450 new Bitcoins are mined daily. If BlackRock’s current inflow trajectory were sustained, its ETF alone would effectively underpin a hypothetical Bitcoin price of roughly USD 780,000 per coin. While purely theoretical, this highlights the immense buying pressure ETFs could exert on Bitcoin’s supply dynamics.

Bitcoin ETF Flow in m$USD over the last four weeks

The total flow trends over time paint a compelling picture of the rapid acceleration of institutional money entering the Bitcoin market.

Total US$m in Bitcoin ETF since inception

Here's a peek into why there's often a disconnect between political rhetoric and public sentiment. When politicians celebrate a "drop" in inflation, they're often not speaking the same language as your wallet, which keeps a tally of the real, cumulative cost. No wonder there's a global political shuffle; people feel the pinch every day, not just in yearly stats.

We want to spotlight a selection of exciting job opportunities for financial professionals in the Bitcoin industry:

Rulematch is looking for a Director of Risk Management

Amongst other open positions, Sygnum is looking for a Relationship Manager Funds & Hedge Funds

Amongst other open positions, Relai is looking for a Senior Compliance Officer EU

Coinfinity is looking for a Money Laundering Prevention Employee