CW49: Long-Term Holders Sell Near $100K, Berne Eyes Sustainable Bitcoin Mining

How Bitcoin "deaths" could have made you $100M, Political interest in mining and why we didn't reach the magical USD 100k mark.

Good morning and welcome to Berglinde Briefing #3!

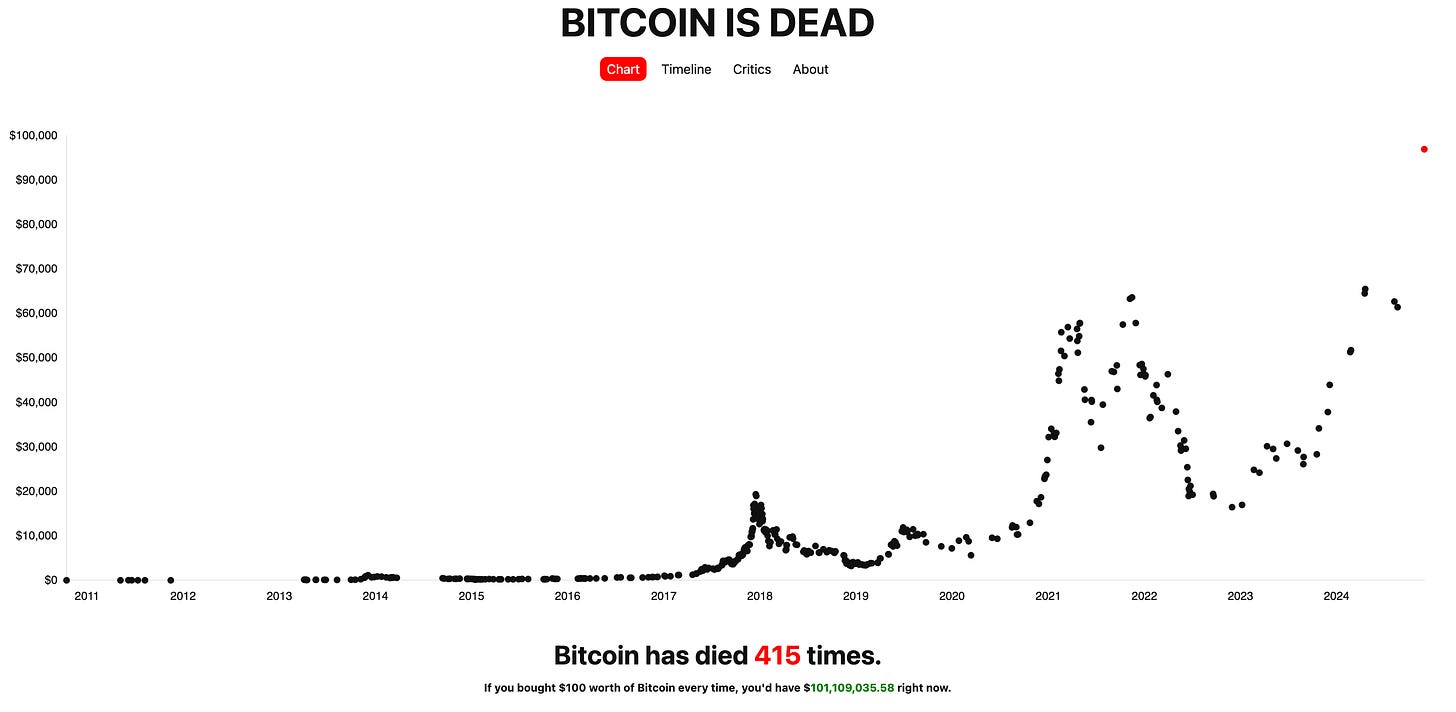

This week, we’re diving into some exciting developments in the Bitcoin world. Did you know you’d be sitting on over $100 million if you bought Bitcoin every time the media declared it dead? It’s a wild stat that shows how resilience (and skepticism) pays off in this space.

We’ll also explore how the canton of Berne is looking to turn stranded energy into Bitcoin, and what it means for sustainable mining. Plus, as Bitcoin flirts with $100K, long-term holders are cashing out—what could this mean for the market?

As always, we’ll wrap up with a bit of fun. Grab your coffee, and let’s kick off the week with some fresh insights!

What we are talking about today

News Flash: Canton of Berne to explore Bitcoin Mining and Why we didn’t cross the USD 100k

Institutional Flows: Institutions started buying again

Graph of The Week: How many times the media declared Bitcoin “death” and how much money you could have made with it

Meme of The Week: The uninformed critic

Flash 1: Canton of Berne to Explore Bitcoin Mining

The canton of Berne’s parliament recently voted 85 to 46 in favor of exploring Bitcoin mining as a solution to stabilize the energy grid and utilize wasted energy. The proposal, initiated by Samuel Kullmann alongside members of political parties from across the spectrum, highlights the potential of Bitcoin to address key energy challenges.

Why Bitcoin Mining Makes Sense for Energy Management:

Utilizes Wasted Energy: Converts surplus energy (e.g., unused hydro or solar power) into a productive resource, reducing energy waste.

Stabilizes the Energy Grid: Acts as a flexible energy consumer, balancing supply and demand, especially with intermittent renewables.

Supports Renewable Energy Growth: Encourages investment in renewable infrastructure by providing an additional revenue stream during periods of low demand.

Boosts Economic Value: Creates local economic opportunities through job creation and tax revenues from mining operations.

Positions Switzerland as a Leader: Reinforces the country’s reputation for innovation in sustainable technology and energy management.

This bipartisan initiative could place Switzerland at the forefront of energy-efficient Bitcoin mining, bridging the gap between financial technology and renewable energy innovation.

Flash 2: Bitcoin Near $100K: Long-Term Holders Take Profits, Market Stays Resilient

Bitcoin has experienced a remarkable rally in recent weeks, coming tantalizingly close to the $100,000 milestone. However, the psychological significance of this level appears to have triggered substantial selling pressure from long-term holders, temporarily stalling the upward momentum.

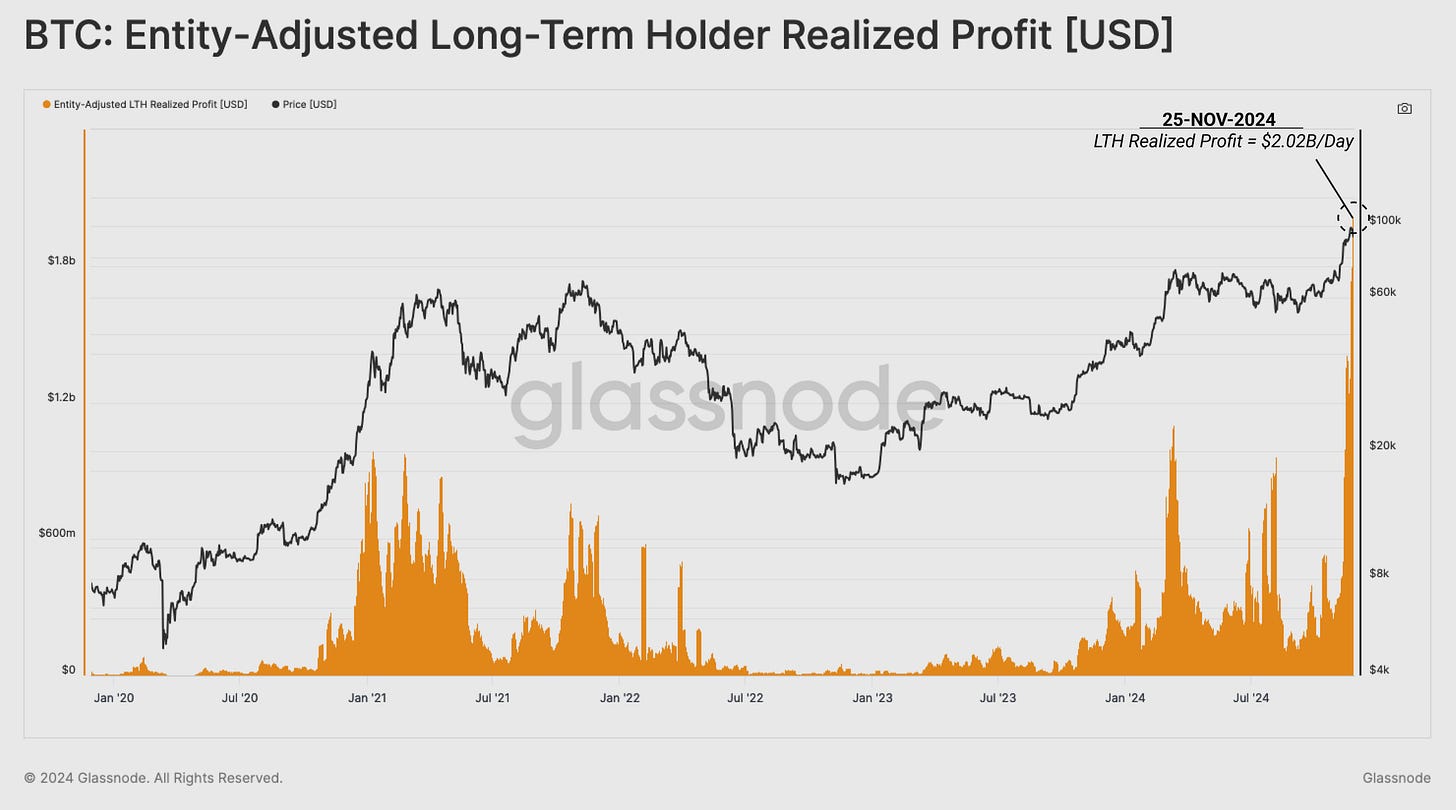

According to Glassnode, this wave of profit-taking is typical of experienced investors, who tend to sell during periods of exuberance. Long-term holders (defined by Glassnode as investors who hold Bitcoin at least six months) have reduced their supply dominance from 78% to 73% over the past month—a significant shift, suggesting they are cashing in on gains after months, or even years, of accumulation.

Interestingly, while older coins are moving to market, there’s no sign of panic. Younger, short-term holders are stepping in, maintaining demand and signaling confidence in Bitcoin’s long-term potential. The current market dynamic reflects a healthy balancing act between old and new investors, underlining Bitcoin’s maturing ecosystem.

For now, it seems the $100,000 barrier is acting as a test of nerves—but as history shows, Bitcoin has a knack for surprising even the savviest market participants.

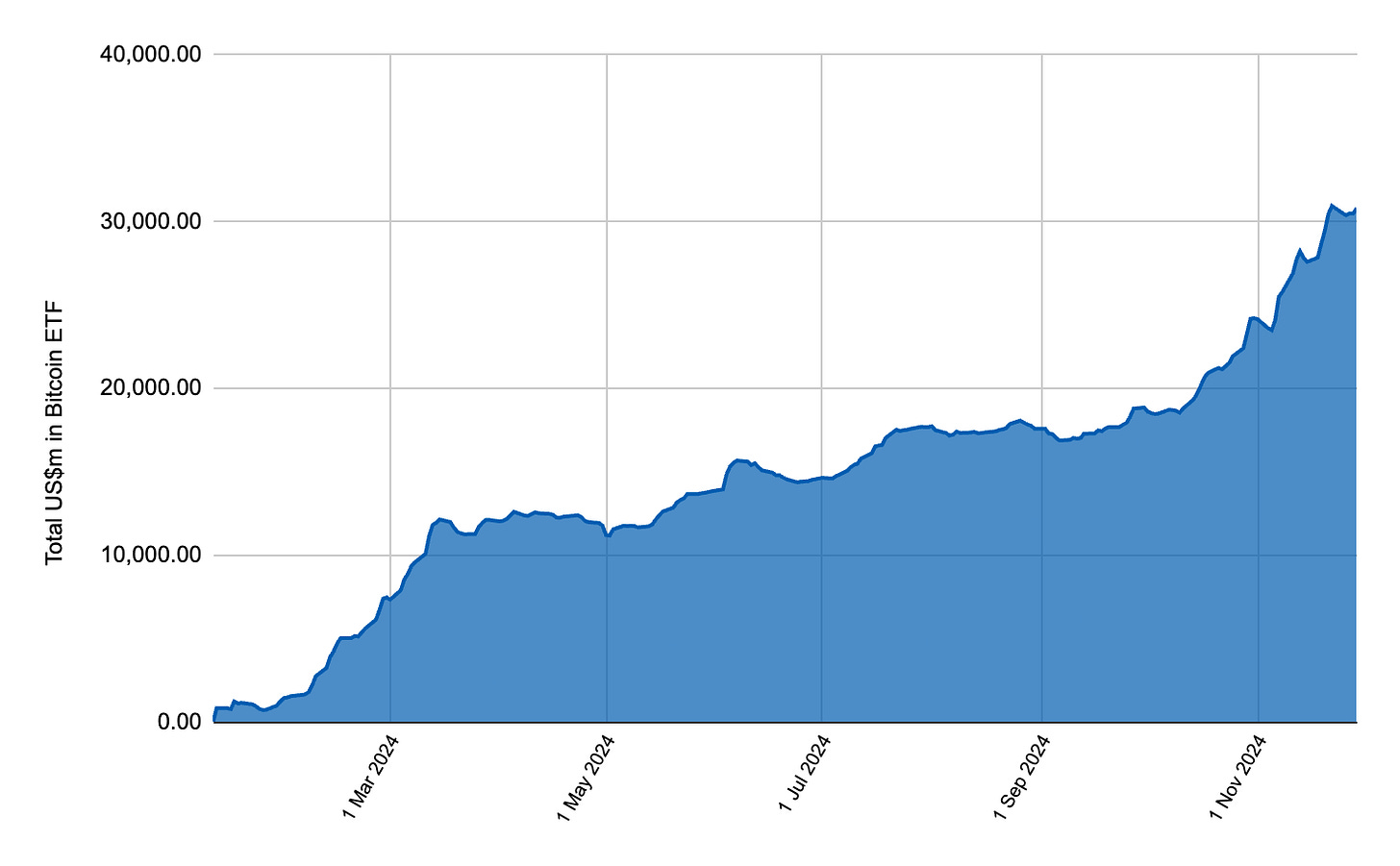

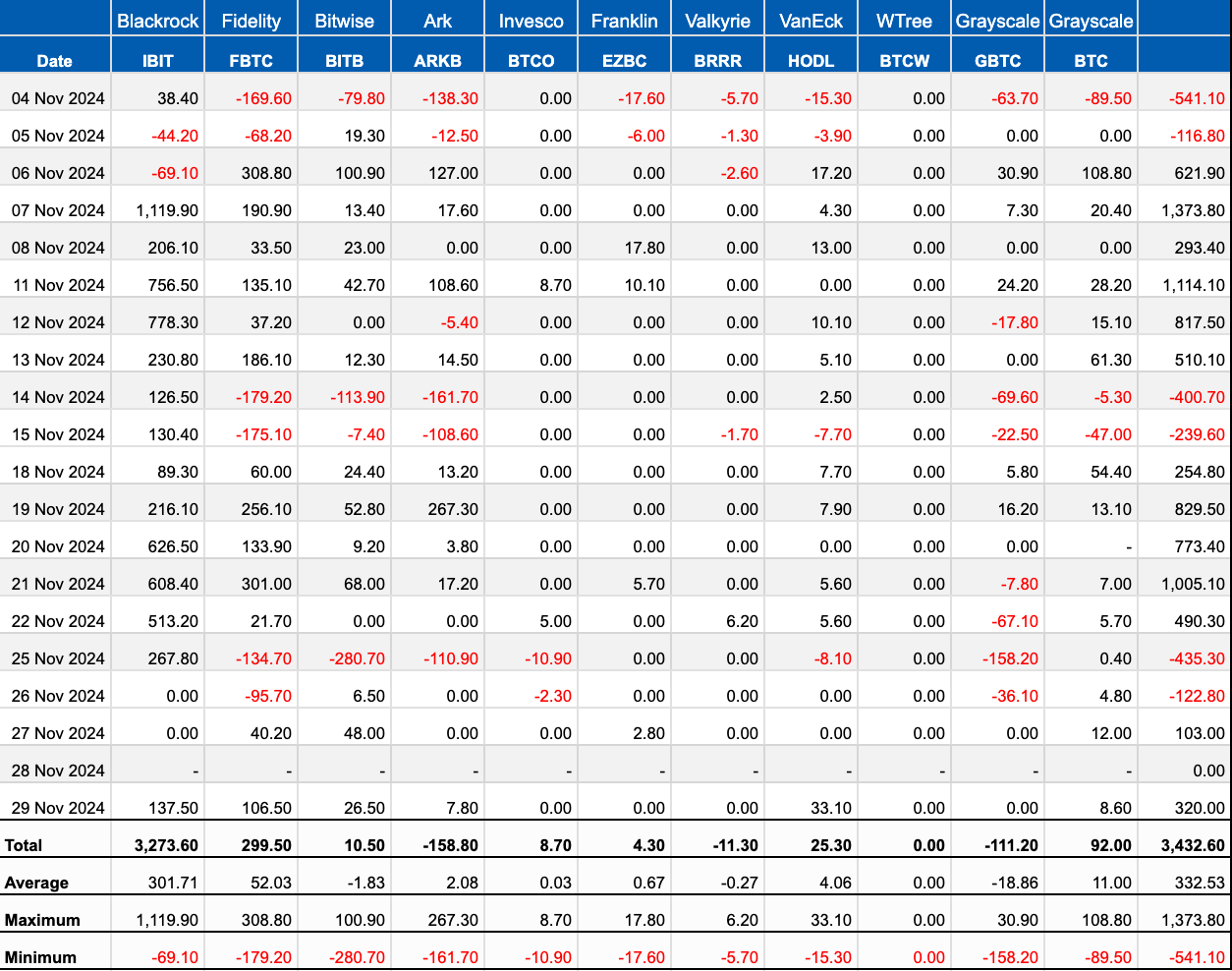

After two weeks of massive inflows into Bitcoin ETFs, momentum has slowed, with net flows essentially stagnating. While small outflows were recorded in some funds, the overall picture remains stable, indicating sustained institutional interest despite Bitcoin's recent rally and nearing the $100,000 mark.

At the same time, large holders continue to strengthen their positions:

Marathon Digital Holdings added 704 BTC as the last chunk of their $1 billion zero-interest convertible note offering, now totaling 6’474 BTC in their latest acquisition. Marathon now holds 34’794 Bitcoin in their treasury, currently valued at around $3.3 billion.

Boyaa Interactive converted much of its Ethereum into Bitcoin, now holding 3,183 BTC, making it Asia’s largest corporate Bitcoin holder.

This trend suggests that major players view this as a strategic accumulation phase, potentially reinforcing Bitcoin’s position as a maturing asset class.

You would own more than USD 100m if you bought $100 worth of Bitcoin every time the media declared it death

BitcoinDeaths.com tracks the 415 times mainstream media has declared Bitcoin "dead." The website humorously highlights that if you had invested just $100 every time this happened, your initial investment would have grown to over $100 million today. It’s a testament to Bitcoin’s resilience and the often short-sighted nature of media narratives. Every "death" was just another buying opportunity for those who believed in its long-term potential—and the numbers don't lie.