CW50: Fed Chair Powell Compares Bitcoin to Gold While Putin Sees Opportunities

How Federal Reserve Chair Jerome Powell compares Bitcoin as a competitor to Gold and Putin touts Bitcoin in place of Dollar Forex reserves.

Welcome to another exciting week at Berglinde Briefing!

Following the recent bull run, Bitcoin has received a significant increase in credibility as a store of value. We will talk about Federal Reserve Chair Jerome Powell's comparison of Bitcoin to Gold rather than the U.S. dollar.

We will also explore Russian President Russian President Vladimir Putin's comments about Bitcoin being more attractive than Dollar forex reserves. Since no one can ban Bitcoin, how do countries leverage this benefit of Bitcoin?

We’ll then wrap up with a bit of fun, exploring interesting facts about investment in Europe and the US.

What we are talking about today

News Flash: Fed Chair Powell compares Bitcoin to Gold, not the USD and Vladimir Putin touts Bitcoin

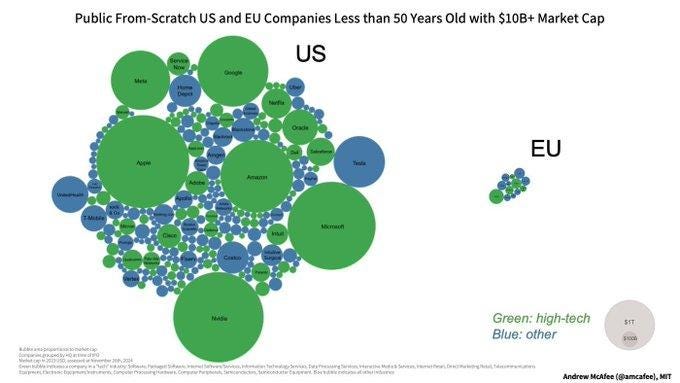

Graph of the Week: How the EU is more of a museum rather than a competitive economy

Deep Dive Resources: Berglinde in the Finanzfabio Podcast

Meme of The Week: Every continent has its strengths

Flash 1: Fed Chair Powell compares Bitcoin to Gold, not the USD

Bitcoin’s meteoric rise got an extra push from the Federal Reserve Chair Jerome Powell who likened Bitcoin as a competitor for Gold rather than the U.S. dollar. While most Bitcoiners like to float Bitcoin as a likely replacement for the U.S. Dollar, Powell sees it differently. In his comments, the central banker views Bitcoin as a speculative asset like Gold, rather than a comparable currency.

Why Bitcoin is more like Gold than fiat currency according to Powell

Speculation: People use Bitcoin as a speculative asset just like Gold, only that it is virtual and digital.

High Volatility: Bitcoin is not used primary form of payment or a reliable store of value because it is highly volatile

Competes with Gold: Bitcoin does not challenge traditional currencies like the U.S. dollar, but competes with Gold.

According to Joel Kruger, market strategist at LMAX Group, The Fed’s chair’s comparison of bitcoin to gold introduces another level of its credibility as a major asset in global markets. His comments provided a sense of legitimacy for Bitcoin, which saw the crypto jump by 3%.

Interestingly, Bitcoin surpassed silver as the world’s eighth most valuable asset with a market capitalization of more than $1.92 trillion and a market value of $1.75. Although still far from gold, which is about 10 times larger, Bitcoin has more room for continued growth.

Berglinde’s take: While we disagree with Jerome Powell’s reasoning, we certainly see it as another step in Bitcoin’s legitimacy. Just a few years ago, Jerome Powell did solely see Bitcoin as a speculative asset without any reason for being. Now we’re at least at “gold stage”, the next acknowledgements will follow with increasing market capitalization.

Flash 2: Vladimir Putin touts Bitcoin

Russian President Vladimir Putin questioned the need to hold state reserves in foreign currencies as they can easily be confiscated for political reasons. On the contrary, domestic investments and bitcoin are more attractive and safe. By acknowledging the growing importance of Bitcoin, Putin demonstrated the transformation of Russia’s financial policy to leverage the advantages of Bitcoin.

Why Bitcoin is better than Dollar forex reserves according to Putin

Dollar Forex Reserves Can Be Lost Easily: Western countries froze over $300 billion of Russian reserves that were accumulated from windfall energy revenues when the Ukrainian War started in 2022. G7 countries are currently discussing how the funds can be used to support Ukraine.

U.S. Administration Undermines the Role of the U.S. Dollar: The U.S. Administration uses the dollar for political purposes, which forces many countries to turn to alternative assets like cryptocurrencies.

Bitcoin is Independent: No one can prohibit Bitcoin and it offers an avenue for the development of new payment technologies due to lower costs and reliability.

The Rise of Bitcoin is Inevitable: Cryptocurrencies like Bitcoin are more than just innovation, but a strategy for counter-sanctions. They reduce dependence on the dollar and provide a natural evolution in global finance since they will continue growing without the impact of the dollar.

His full speech can be found here:

Putin’s comments reflect a broader shift in many countries’ financial policies. As Bitcoin continues to rise, the global use of the U.S. dollar is declining. This shift is mainly driven by US policies rather than external forces, which has seen countries like Russia embrace cryptocurrencies as a way of bypassing restrictions imposed by Western countries.

Berglinde’s take: No matter where you stand on any geopolitical questions, times like these are when Bitcoin shines. “Bitcoin is for enemies” as we say goes in all directions and it definitely shows how important the asset has become. And fundamentally, Putin is right. No one can prohibit Bitcoin and its useage and no one can control it. Which is exactly its strength and its interesting to watch world leaders realizing this.

How the EU is more of a museum rather than a competitive economy

In a hard-hitting visualization by Andrew McAfee, the EU appears as a rounding error compared to the US in terms of large companies that have started in the last 50 years. The difference between the two in $10B+ companies is a striking 70x.

The graph raises an interesting question: Is Europe becoming a museum as a continent and a museum as a stock market?

Berglinde in Finanzfabio’s podcast (in Swiss-German)

We had the pleasure of joining the Finanzfabio Podcast to talk about Bitcoin’s trajectory and Berglinde. This conversation dives into why Bitcoin is becoming a cornerstone of modern finance and how Berglinde is positioned to lead the charge in this space.

Tune in to hear about our vision, the exciting opportunities in Bitcoin-backed lending, and how we’re shaping the future of Bitcoin in institutional finance.

Listen to the episode on Spotify or any other podcast platform you prefer.